Loading

Get Canada T1135 E 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1135 E online

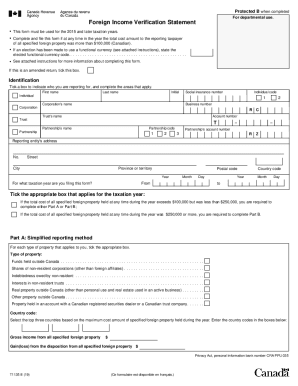

Filling out the Canada T1135 E form, also known as the Foreign Income Verification Statement, is essential for Canadian taxpayers who have specified foreign property exceeding a certain value. This guide provides a user-friendly step-by-step approach to help you complete the form accurately and efficiently online.

Follow the steps to complete the T1135 E form online.

- Press the ‘Get Form’ button to access the T1135 E form and open it for editing.

- Indicate your identification by ticking the appropriate box that applies to you, whether you are an individual, corporation, trust, or partnership. Fill in the required fields including first name, last name, and social insurance number where applicable.

- Specify the taxation year for which you are filing the form. Enter the year in the provided fields.

- Determine if the total cost of all specified foreign property held during the year exceeds $100,000 but is less than $250,000 or was $250,000 or more. Select Part A or Part B accordingly.

- If completing Part A, tick the boxes for the types of specified foreign property you hold, including funds held outside Canada, shares of non-resident corporations, and more.

- For Part B, fill in the detailed tables for each category of specified foreign property. Include necessary details such as country codes, descriptions, maximum cost amounts, and any income or gains/losses associated with each property.

- Once all information is accurately entered, certify that the information provided is correct by signing in the certification section, including your name, title, and date.

- Finally, save your changes to the form, and you have the option to download, print, or share the completed T1135 E form.

Complete your T1135 E form online now to ensure compliance with reporting requirements.

Who has to file a T1135? A T1135 must be filed by: Canadian resident individuals, corporations and trusts that, at any time during the year, own specified foreign property costing more than $100,000; and. certain partnerships that hold more than $100,000 of specified foreign property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.