Loading

Get 2015 Form 3500a -- Submission Of Exemption Request - California ... - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

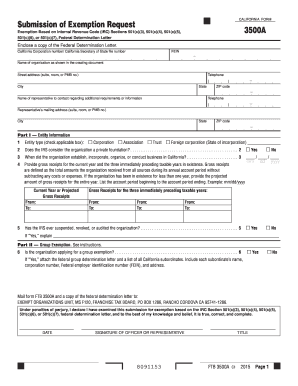

How to fill out the 2015 Form 3500A -- Submission of Exemption Request - California online

Completing the 2015 Form 3500A for an exemption request in California can seem daunting. This guide offers a detailed, step-by-step approach to assist you in effectively filling out the form online.

Follow the steps to complete the exemption request form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the organization’s name exactly as it appears in the creating document. Make sure to provide the full street address, including suite or room numbers, along with your telephone number.

- Input the California corporation number or Secretary of State file number, followed by the organization’s Federal Employer Identification Number (FEIN).

- In Part I — Entity Information, check the applicable box for your entity type, whether it be a corporation, association, trust, or foreign corporation.

- Indicate if the IRS considers the organization a private foundation by selecting 'Yes' or 'No'.

- Provide the date when the organization established, incorporated, organized, or commenced business in California, in the format mm/dd/yyyy.

- Enter the gross receipts for the current year and the three immediately preceding tax years. If the organization has been operational for less than a year, estimate the total receipts for the full year.

- Indicate whether the IRS has ever suspended, revoked, or audited your organization by selecting 'Yes' or 'No'. If yes, provide a brief explanation.

- In Part II, if applying for a group exemption, select 'Yes' or 'No', and attach the federal group determination letter along with a list of all California subordinates, including their names and relevant details.

- After completing all sections, sign and date the form, ensuring that the signature is from an authorized officer or representative, along with their title.

- Finally, save your changes, download, and print the form or share it as necessary. Remember to mail the completed form and a copy of the federal determination letter to the provided address.

Complete your documents online today to ensure a smooth submission process.

We characterize a nonprofit organization according to how it was created. Tax-exempt means the organization is not required to pay California franchise or income taxes on the money the organization receives related to its exempt activities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.