Loading

Get 2008 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2008 Form online

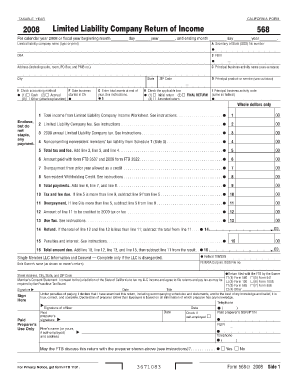

This guide provides a clear and supportive approach to completing the 2008 Form online. Whether you are familiar with tax forms or new to the process, this guide aims to assist you with step-by-step instructions for each section.

Follow the steps to accurately complete the 2008 Form.

- Press the 'Get Form' button to access the 2008 Form and open it in your online editor.

- Fill in the calendar year or fiscal year details at the top of the form. Provide the start and end dates if applicable, ensuring accuracy as this information is critical for processing.

- Complete the total income section by referring to the Limited Liability Company Income Worksheet included with the instructions. Enter the total income amount.

- Input the Limited Liability Company fee as indicated in the instructions. This amount should reflect the specific fee for the 2008 tax year.

- Enter the annual Limited Liability Company tax amount as guided by the instructions for this form.

- For nonconsenting nonresident members’ tax liability, refer to Schedule T (Side 3) and accurately report the amounts required.

- Calculate and enter the total tax and fee by adding lines 2, 3, and 4 together. This total is crucial for your overall tax liability.

- Report any payments made with Form FTB 3537 and Form FTB 3522. Ensure these amounts are current and correctly reported.

- Address any overpayment credits from the prior year, making sure to include those amounts as applicable.

- Review the nonresident withholding credit section, ensuring to follow the guidance given in the instructions.

- Add together lines for total payments, which consist of amounts from lines 6, 7, and 8.

- Determine if you have a tax and fee due by subtracting total payments from total tax and fee. This determines whether you owe or are owed a refund.

- Fill in the refund section if applicable, stating any overpayment.

- Complete the relevant schedules as needed based on your specific business activities and structures, including Schedule A for cost of goods sold and Schedule B for income and deductions.

- Finally, save your changes. You can download, print, or share the completed form as needed.

Complete your 2008 Form online today to ensure timely and accurate filing.

The W-8BEN is an Internal Revenue Service (IRS) mandated form to collect correct Nonresident Alien (NRA) taxpayer information for individuals for reporting purposes and to document their status for tax reporting purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.