Loading

Get Texas Sales And Use Tax Permit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Sales And Use Tax Permit online

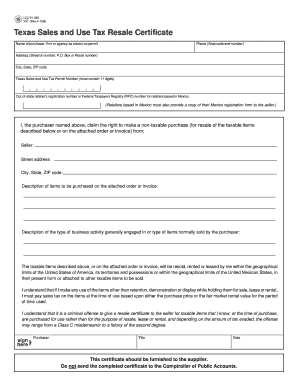

Filling out the Texas Sales And Use Tax Permit online is an essential step for businesses to comply with state tax regulations. This guide provides clear, step-by-step instructions to help users complete the permit accurately and efficiently.

Follow the steps to complete the Texas Sales And Use Tax Permit online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name, firm or agency name as shown on the permit. Ensure accuracy to avoid issues with processing your application.

- Enter your phone number, including the area code. This information is important for communication regarding your application.

- Include your address, specifying the street number, P.O. Box, or route number. Accuracy here is also critical.

- Input your city, state, and ZIP code to complete your address details.

- Fill in your Texas Sales and Use Tax Permit Number, ensuring it contains 11 digits as required.

- For out-of-state retailers or retailers based in Mexico, enter the registration number or Federal Taxpayer Registry (RFC) number as applicable.

- Indicate the seller's name and provide their street address, city, state, and ZIP code for clarity in the transaction.

- Describe the taxable items you are purchasing in detail. This section must match the attached order or invoice.

- Outline the type of business activity you are generally engaged in or the type of items you normally sell. This information helps in verifying the legitimacy of your permit.

- Acknowledge the understanding of tax responsibilities by reviewing the statements provided in the permit about the correct utilization of purchased items.

- Sign the form by adding your name, title, and date of completion, confirming the information is accurate.

- Once all fields are filled out, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your Texas Sales And Use Tax Permit online today for a seamless filing experience.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.