Loading

Get Ohio Repossession Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio Repossession Form online

Completing the Ohio Repossession Form online can be a straightforward process if approached in an organized manner. This guide will walk you through each section of the form to ensure you provide the necessary information accurately and effectively.

Follow the steps to complete the Ohio Repossession Form with ease.

- Click ‘Get Form’ button to access the Ohio Repossession Form and open it in the editing tool.

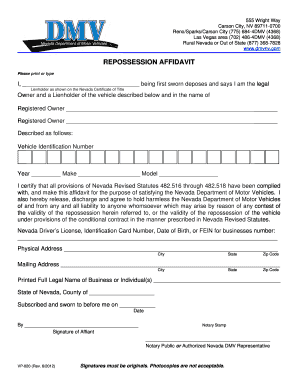

- Begin by filling out your information in the designated fields, including your full name and contact details. Ensure that all entries are accurate and complete.

- Next, indicate your status as the legal lienholder by providing details as shown on the Ohio Certificate of Title. This section is important for validating your claim.

- In the vehicle description section, enter the vehicle identification number (VIN), year, make, and model of the vehicle being repossessed. Double-check this information for accuracy.

- Affirm that you have complied with all relevant statutes by confirming your understanding and acceptance of the related legal requirements outlined in the form.

- Provide your driver's license or identification card number, date of birth, and the physical address where you can be reached. Make sure this information is clear and correctly formatted.

- Fill in the mailing address if it differs from your physical address to ensure you receive all relevant correspondence regarding the repossession.

- Sign the form in the designated area to verify the accuracy of the information provided. Note that signatures must be original, without photocopies.

- Finally, review the completed form thoroughly. Save your changes, and if necessary, download, print, or share the document as required.

Fill out the Ohio Repossession Form online today to streamline your repossession process.

Paying off a repossession can help your credit score since it reduces debt owed, and you may be able to get the item removed from your credit report. However, the significance of impact on your score depends on your credit history and profile and whether you take a settlement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.