Loading

Get 1099 Reporting Service - Signature Information Solutions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Reporting Service - Signature Information Solutions online

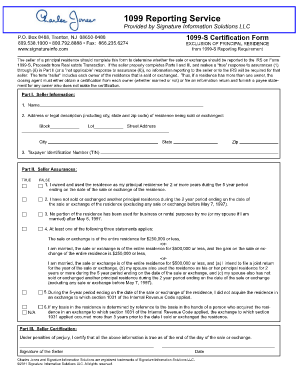

Filling out the 1099 Reporting Service - Signature Information Solutions form online is a straightforward process that ensures compliance with federal regulations regarding real estate transactions. This guide will walk you through each step, helping you complete the form accurately and efficiently.

Follow the steps to successfully complete the 1099 Reporting Service form online.

- Press the ‘Get Form’ button to acquire the 1099 Reporting Service form and open it for editing.

- Begin by entering your account number, if known, followed by your firm or company name.

- Provide your name and title, along with the full address including city, state, and zip code.

- Fill in your telephone number, including the area code, and fax number if applicable.

- Enter your email address, along with your Federal Tax Identification number or Social Security number.

- Select whether you are a service agent filing on behalf of other closing agents or a closing agent yourself.

- Review and authorize Signature Information Solutions LLC to transmit the information returns to the IRS, ensuring you understand the applicant's responsibilities regarding information collection.

- Acknowledge that Signature will provide verification of entered transactions and that you are responsible for any necessary corrections.

- Confirm that Signature will forward a copy of the information return to the seller by January 31 of the following year.

- Be aware that all 1099-S information submissions must be completed online by the second Friday of January following the transaction.

- Finalize the form by signing, printing your name, and dating the document. Make sure to review all entered information for accuracy before completing.

- At the end, save your changes, download, print, or share the filled form as necessary.

Complete your 1099 Reporting Service form online today and ensure compliance with IRS regulations.

Let's have a closer look at Form 1099-S instructions: In Box 1, the filer must enter the date of closing for the property. In Box 2, enter the gross proceeds, this is the cash amount that the transferor will receive in exchange for the property. In Box 3, enter the address and/or legal description of the property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.