Loading

Get Occlicenseboonecountykyorg Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Occlicenseboonecountykyorg Form online

Filling out the Occlicenseboonecountykyorg Form online can be straightforward with the right guidance. This comprehensive guide will help you navigate through each section of the form with ease, ensuring that you provide all necessary information accurately.

Follow the steps to successfully complete the form online.

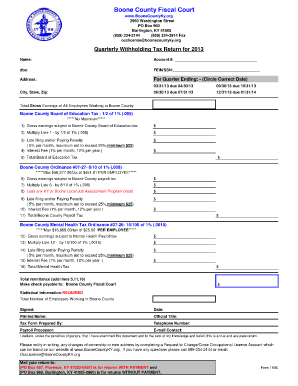

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the designated field at the top of the form. Ensure it matches the name registered with the relevant authorities.

- Fill in your account number accurately. This is crucial for the processing of your submission.

- Provide the ‘dba’ (doing business as) name if applicable. This is the name under which your business operates.

- Input your FEIN (Federal Employer Identification Number) or SSN (Social Security Number) in the specified area.

- Select the correct quarter ending date by circling the appropriate date. This is important for accurate tax reporting.

- Fill in your business address, including city, state, and zip code, to ensure proper identification.

- Calculate the total gross earnings of all employees working in Boone County. Enter this amount in the provided field.

- Complete the calculations for the Boone County Board of Education Tax by following the outlined steps from 1 to 5, ensuring each calculation is accurate.

- Proceed with the Boone County Payroll Tax section, calculating amounts for lines 6 through 11.

- Complete the Mental Health Tax section by calculating amounts for lines 12 through 16.

- Add the total amounts from lines 5, 11, and 16 to obtain your total remittance. This is the sum you will need to report.

- Sign and date the form in the relevant sections to confirm the accuracy of the information provided.

- Ensure to include the printed name and official title of the person completing the form.

- Fill in the tax form prepared by section, including the telephone number and email contact related to the submission.

- Once all sections are completed, review the form for accuracy. Save your changes, download a copy, print it out, and share if necessary.

Complete your forms online today for a seamless filing experience.

The payroll rate is 2% of all wages and or compensation paid or payable for work done, or services performed or rendered in the city, by every resident and nonresident who is an employee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.