Loading

Get Form Ohio Itsd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ohio Itsd online

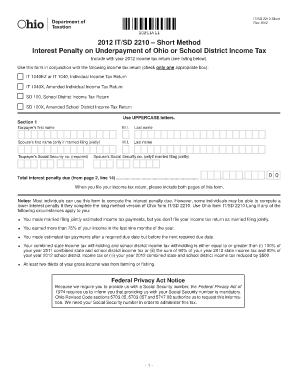

The Form Ohio Itsd is used to calculate the interest penalty on underpayment of Ohio or school district income tax. This guide provides step-by-step instructions to assist users in successfully filling out the form online, ensuring compliance and accuracy.

Follow the steps to complete the Form Ohio Itsd online.

- Press the ‘Get Form’ button to download the form and open it in the editor.

- Begin by filling in Section 1 with your information. Provide your first name, middle initial, and last name using UPPERCASE letters. If you are married and filing jointly, include your spouse’s information below yours.

- Enter your Social Security number in the specified field; if married filing jointly, provide your spouse's Social Security number as well. This information is mandatory for processing.

- Calculate the total interest penalty due using the provided sections on the form. You will refer to page 2 for specific calculations based on your income tax details from the previous tax year.

- After completing all sections of the form, review your entries for accuracy and completeness, ensuring that all required information is filled out.

- Finally, save any changes you made, and choose to download, print, or share the completed form as needed to accompany your income tax return.

Start filling out your Form Ohio Itsd online today to ensure timely and accurate submission.

The IT-4708 is an Ohio composite tax return. Here the partnership files this return and pays the tax for those nonresident partners included. With this filing, the nonresident partners do not have to file a separate individual Ohio tax return. Partnerships doing business in Ohio may need to file the Ohio CAT return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.