Loading

Get Az Form 309

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Az Form 309 online

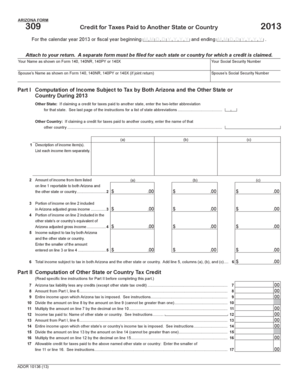

Filling out the Az Form 309 is essential for claiming a credit for taxes paid to another state or country. This guide will provide you with clear and detailed instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Az Form 309 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In the first section, provide your name and Social Security Number as indicated. If filing jointly, include your partner's name and Social Security Number.

- For Part I, enter the abbreviation of the other state if claiming a credit for taxes paid to another state or the name of the other country if applicable. List all income items separately in line 1.

- On line 2, specify the amount of income from each item listed that is reportable to both Arizona and the other state or country.

- Complete lines 3 and 4 by indicating the portion of income from line 2 included in Arizona adjusted gross income and the portion included in the other state's or country's equivalent of adjusted gross income.

- On line 5, enter the smaller amount from lines 3 or 4, which reflects the income subject to tax by both Arizona and the other state or country.

- Continue to Part II, where you will compute the other state or country tax credit, starting from line 7 and following the specific instructions for each line carefully.

- At the end of Part II, summarize your allowable credit for taxes paid and ensure all calculations are consistent with the provided guidelines.

- After completing all sections, ensure to save your changes, and then you can download, print, or share the form as needed.

Start completing your Az Form 309 online to ensure you receive the credits you deserve.

(a) Residents: An Oregon resident is allowed a credit for taxes paid to another state on mutually taxed income if the other state does not allow the credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.