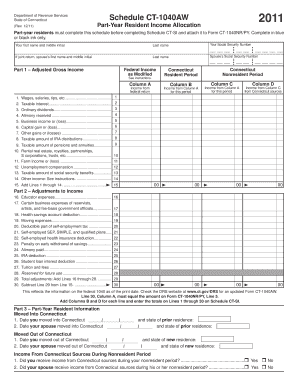

Get Ct 1040aw

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Ct 1040aw online

How to fill out and sign Ct 1040aw online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Are you still searching for a fast and practical tool to fill out Ct 1040aw at a reasonable price? Our service will provide you with a rich selection of forms available for filling in on the internet. It takes only a couple of minutes.

Follow these simple instructions to get Ct 1040aw completely ready for submitting:

- Get the form you will need in the collection of templates.

- Open the document in the online editor.

- Read through the recommendations to determine which data you will need to give.

- Choose the fillable fields and add the necessary info.

- Put the date and place your electronic signature after you fill out all of the fields.

- Look at the completed form for misprints along with other errors. In case you necessity to change something, our online editor along with its wide variety of tools are available for you.

- Download the completed form to your device by clicking Done.

- Send the electronic document to the intended recipient.

Filling out Ct 1040aw does not really have to be stressful any longer. From now on simply cope with it from your home or at the business office right from your mobile or PC.

How to edit Ct 1040aw: customize forms online

Make the best use of our powerful online document editor while preparing your forms. Fill out the Ct 1040aw, indicate the most important details, and effortlessly make any other necessary alterations to its content.

Preparing documents electronically is not only time-saving but also gives an opportunity to edit the template according to your needs. If you’re about to manage the Ct 1040aw, consider completing it with our extensive online editing tools. Whether you make a typo or enter the requested details into the wrong field, you can easily make adjustments to the document without the need to restart it from the beginning as during manual fill-out. Apart from that, you can stress on the crucial information in your document by highlighting specific pieces of content with colors, underlining them, or circling them.

Follow these quick and simple steps to fill out and modify your Ct 1040aw online:

- Open the file in the editor.

- Provide the necessary information in the empty areas using Text, Check, and Cross tools.

- Adhere to the form navigation to avoid missing any mandatory areas in the template.

- Circle some of the crucial details and add a URL to it if needed.

- Use the Highlight or Line options to stress on the most important facts.

- Select colors and thickness for these lines to make your form look professional.

- Erase or blackout the facts you don’t want to be visible to other people.

- Replace pieces of content that contain errors and type in text that you need.

- End up editing with the Done option once you make certain everything is correct in the form.

Our powerful online solutions are the simplest way to fill out and modify Ct 1040aw according to your demands. Use it to prepare personal or professional documents from anyplace. Open it in a browser, make any alterations in your documents, and return to them anytime in the future - they all will be securely stored in the cloud.

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.