Loading

Get Form 4862

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4862 online

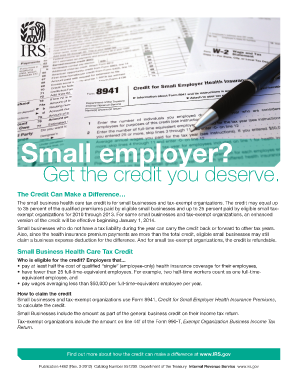

Filling out Form 4862 online can help small employers access valuable tax credits for health insurance premiums paid for employees. This guide provides clear and supportive instructions to help users understand and complete the form effectively, even if they have limited legal experience.

Follow the steps to complete the Form 4862 online easily.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Begin by entering your basic information, including your name, business name, and contact information in the designated fields.

- In the next section, provide details about your health insurance coverage, including the number of employees covered and the amount of premiums paid.

- Outline your business structure and the number of full-time-equivalent employees to determine your eligibility for the credit.

- Calculate the total health insurance premiums that qualify for the credit and input that amount in the specified field.

- Review your entries carefully for accuracy and completeness before finalizing the form.

- Once your information is correct, you can save your changes, download the form, print it, or share it as needed.

Start filling out your Form 4862 online today to claim the tax credit your small business deserves.

The TaxAct program does not provide Form 4852, so you will need to print a hard copy of your return, attach Form 4852, and mail it to the IRS. To substitute Form W-2: Download and print Form 4852 from the IRS Website. Manually complete Form 4852.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.