Loading

Get Mortgage Payoff Statement Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Payoff Statement Template online

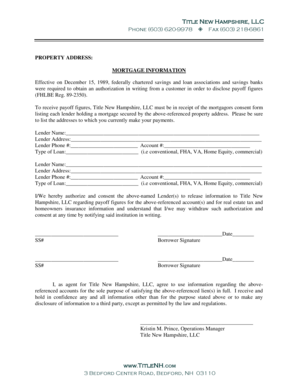

Filling out the Mortgage Payoff Statement Template is a crucial step in understanding your loan repayment status. This guide provides a clear, step-by-step approach to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Mortgage Payoff Statement Template online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the property address in the designated field. This should be the location associated with the mortgage in question.

- Provide details for your mortgage by filling in the lender name. This refers to the financial institution holding your mortgage.

- Next, input the lender's address. Ensure that you include complete information for accurate communication.

- Fill in the lender's phone number and your account number. This information is essential for the lender to identify your mortgage.

- Indicate the type of loan you have by selecting one of the options such as conventional, FHA, VA, home equity, or commercial.

- If you have multiple lenders, repeat steps 3 through 6 for each lender involved in your mortgages.

- Read and understand the consent statement regarding the release of information. You will need to sign and date the document.

- Make sure to include your Social Security number in the designated fields and confirm that the information is correct.

- Finally, review all entered information for accuracy. Once confirmed, you can save changes, download, print, or share the completed form.

Start your document management process by completing the Mortgage Payoff Statement Template online today!

Under federal law, the servicer is generally required to send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.