Loading

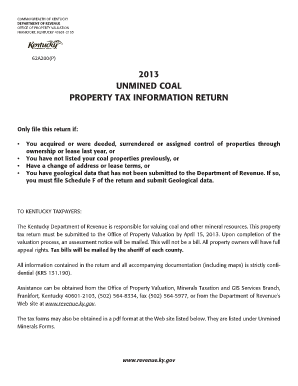

Get Unmined Coal Tax Kentucky Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Unmined Coal Tax Kentucky Form online

Filling out the Unmined Coal Tax Kentucky Form online can be a streamlined process if you follow the correct steps. This guide will provide you with clear and concise instructions to help you successfully complete the tax information return.

Follow the steps to fill out the Unmined Coal Tax Kentucky Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the filer information section where you need to enter your name, mailing address, city, state, telephone number, zip code, and either your Social Security number or federal I.D. number.

- Indicate the county where the property is located and ensure all applicable schedules are completed as requested. Incomplete filings will not be accepted.

- Review verification information where you will sign off under penalties of perjury, affirming that the information provided is true, correct, and complete.

- Complete Schedule A for fee property ownership or Schedule B for leased property as applicable. Provide details such as owner’s parcel identifier, property location, and other relevant information about the coal seams owned or leased.

- If applicable, complete Schedule C for property or stock transfers, detailing the type of transaction, buyer, seller, transaction price, and other pertinent information.

- If geological information is relevant, complete Schedule F with all required details regarding any exploration data submitted.

- After filling in all necessary sections and schedules, review the entire form for accuracy and completeness.

- Save your form, and then download or print a copy for your records.

- Submit the completed return to the designated Department of Revenue address listed in the form.

Start filling out the Unmined Coal Tax Kentucky Form online today to ensure a timely submission.

A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a full-year nonresident files Form 740-NP.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.