Loading

Get Pa Schedule W 2s

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA Schedule W-2s online

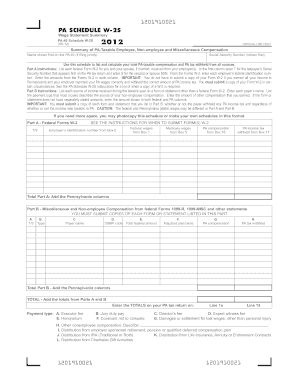

The PA Schedule W-2s is an essential document for reporting taxable compensation and tax withheld in Pennsylvania. This guide will provide you with clear and detailed instructions on how to accurately complete the form online.

Follow the steps to fill out the PA Schedule W-2s effectively.

- Press the ‘Get Form’ button to retrieve the PA Schedule W-2s and open it in your preferred editor.

- In the first section, enter the name shown first on the PA-40 tax return, as well as the Social Security Number (SSN) associated with that name.

- Proceed to Part A. For each federal Form W-2 received from your employer, designate whether it is for the taxpayer or spouse by entering 'T' or 'S' respectively in the first column.

- Enter each employer’s federal identification number from Box b of the Form W-2.

- Fill in the federal wages from Box 1, Medicare wages from Box 5, PA compensation from Box 16, and PA income tax withheld from Box 17 for each employer.

- After completing the entries in Part A, total the Pennsylvania columns and ensure that the amounts are calculated correctly.

- Next, navigate to Part B. List any additional income received on forms other than the federal Form W-2, including the payer’s name and the type of non-employee compensation.

- Enter the total federal amount and any adjusted plan basis as required in the respective columns.

- Make sure to submit copies of each listed form or statement in Part B, regardless of whether PA income tax was withheld.

- Sum the totals from Parts A and B, and ensure these totals are entered accurately on your PA tax return.

- Once you have filled out all sections of the form, make sure to save your changes, and you may also choose to download, print, or share the completed document.

Complete your PA Schedule W-2s online to ensure accurate reporting and compliance.

Related links form

SUT PA State EE Unemployment tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.