Loading

Get Mortgage Comparison Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Comparison Worksheet online

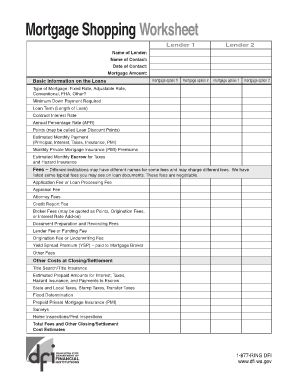

Filling out the Mortgage Comparison Worksheet online helps users systematically assess different mortgage options and make informed decisions. This guide will provide clear, step-by-step instructions to assist you in completing each section of the worksheet with confidence.

Follow the steps to effectively complete the Mortgage Comparison Worksheet

- Click ‘Get Form’ button to obtain the Mortgage Comparison Worksheet and open it in your preferred online editor.

- Begin by entering the lender information. Fill in the names of the lenders you are comparing and include the name and contact details of each lender's representative.

- Next, specify the mortgage amount you wish to compare. Ensure this amount reflects the total sum you are seeking to borrow.

- For each mortgage option, identify the type of mortgage by selecting from the choices provided: Fixed Rate, Adjustable Rate, Conventional, FHA, or Other.

- Indicate the minimum down payment required for each mortgage option you are assessing.

- Enter the loan term, which is the length of the loan, typically expressed in years.

- Fill in the contract interest rate and the annual percentage rate (APR) for each mortgage option.

- Include information about points, which may be called Loan Discount Points, associated with both mortgage options.

- Calculate the estimated monthly payment, detailing the costs for principal, interest, taxes, insurance, and any private mortgage insurance (PMI) premiums.

- Document the estimated monthly escrow for taxes and hazard insurance for each mortgage.

- List any applicable fees for each lender, including the application fee, appraisal fee, attorney fees, and any broker fees, specifying any alternative terms used.

- Review the other costs at closing or settlement, such as title insurance and any prepaid amounts. Be thorough to ensure all potential costs are recorded.

- Consider additional questions and concerns about the loan. This includes prepayment penalties, lock-in agreements, and any insurance costs associated with the loan.

- Once completed, save the changes made to your worksheet. You can then download, print, or share the form as needed.

Take the next step in your mortgage journey by completing your Mortgage Comparison Worksheet online today.

What is a comparison rate? A comparison rate includes the interest rate as well as certain fees and charges relating to a loan. The aim of the comparison rate is to help you identify the true cost of a loan and compare loans and services offered by financial institutions and mortgage providers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.