Loading

Get Td1ab

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Td1ab online

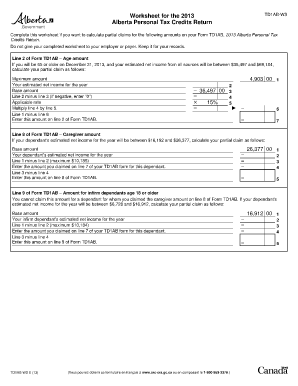

Filling out the Td1ab form online is an essential step for users looking to claim personal tax credits in Alberta. This guide will walk you through the components of the form and provide step-by-step instructions to make the process efficient and clear.

Follow the steps to accurately complete your Td1ab form

- Press the ‘Get Form’ button to access the Td1ab form and open it in your online document editor.

- Begin by entering your personal information at the top of the form. This typically includes your name, address, and social insurance number.

- Proceed to Line 2 for the age amount. If you will be 65 or older by December 31, insert your estimated net income to determine eligibility for the age credit.

- Complete the calculations as outlined: subtract Line 3 from Line 2, assess the applicable rate, and multiply the result to find the claim amount for Line 2.

- Move on to Line 8 for the caregiver amount. If applicable, enter your dependant’s estimated income and follow the calculation steps to determine the claim for this line.

- For Line 9, evaluate if you can claim for infirm dependants aged 18 or older. Follow the same format of income assessment and subtraction as before to complete this line.

- Review all entries for accuracy before saving changes. You can download, print, or share your completed form as needed.

Complete your Td1ab form online today to ensure you receive the appropriate tax credits.

The federal basic personal amount comprises two elements: the base amount ($13,521 for 2023) and an additional amount ($1,479 for 2023).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.