Loading

Get Rp 425 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rp 425 Form online

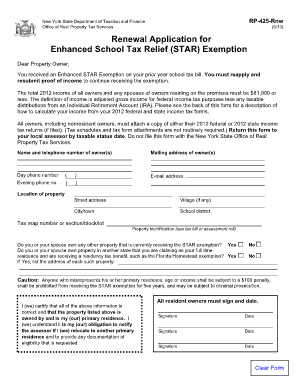

Filling out the Rp 425 Form online is a crucial step to maintain your Enhanced School Tax Relief exemption. This guide will provide you with detailed instructions on each section of the form to ensure a smooth application process.

Follow the steps to complete the Rp 425 Form online

- Press the ‘Get Form’ button to access the Rp 425 Form and open it in your chosen editor.

- Enter the name(s) and telephone number(s) of all owners in the designated fields. Make sure to include the mailing address for each owner.

- Provide the location of the property by completing the street address, city/town, school district, and tax map number or section/block/lot fields.

- Indicate whether you or your partner own any other properties currently receiving the STAR exemption by selecting 'Yes' or 'No'. If applicable, list the addresses of those properties.

- Certify that all the information provided is correct and indicate whether the property is your primary residence by signing and dating the form. All resident owners must complete this section.

- Review the guidelines provided for income calculation, ensuring that the total income does not exceed the specified thresholds, and attach a copy of the required income tax returns if applicable.

- Once all required fields are completed and verified for accuracy, save your changes. You may then download, print, or share the form as necessary.

Complete your Rp 425 Form online today to maintain your tax exemption.

You can receive the STAR credit if you own your home and it's your primary residence and the combined income of the owners and the owners' spouses is $500,000 or less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.