Loading

Get If I Am Filing It 140nrs Do I Need To File It 140 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the If I Am Filing It 140nrs Do I Need To File It 140 Form online

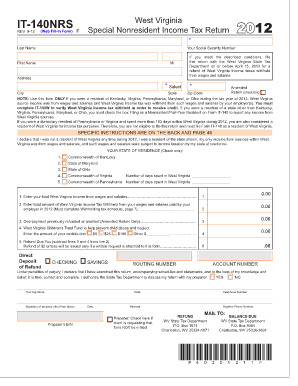

Filing your West Virginia Special Nonresident Income Tax Return, known as Form IT-140NRS, is essential for claiming a refund on any taxes withheld from your wages and salaries. This guide provides clear, step-by-step instructions for users of all experience levels to successfully complete this form online.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your last name and first name in the designated fields. Make sure to include the correct spelling as it appears on your Social Security card.

- Input your Social Security number to verify your identity. Ensure that the number is accurate to avoid any processing delays.

- Provide your mailing address, including city, state, and zip code. This information is crucial for any correspondence regarding your return.

- Select if you are filing an amended return by checking the appropriate box, if applicable.

- Choose your state of residence from the options provided, ensuring that your selection aligns with your residency status during the tax year.

- Fill in the number of days spent in West Virginia during the tax year, as this may affect your tax filing status.

- Enter your total West Virginia income from wages and salaries. Make sure to double-check that this figure reflects your income accurately.

- Input the total amount of West Virginia income tax withheld from your wages, as reported by your employer. This information is necessary to determine your refund.

- If applicable, enter any overpayment that was previously refunded or credited. This is vital if you are filing an amended return.

- Calculate the refund due to you by subtracting the amounts on the relevant lines. Ensure that this reflects your correct refund amount.

- If you wish to contribute to the West Virginia Children's Trust Fund, enter your desired contribution amount.

- Indicate whether you would like your refund deposited directly into your checking or savings account. Provide your routing and account numbers to facilitate this transfer.

- Review all provided information for accuracy. Once verified, save any changes and prepare to download, print, or share the completed form as needed.

Complete your IT-140NRS Form online today to ensure your tax refund is processed efficiently.

EEOC Regulations require that employers keep all personnel or employment records for one year. If an employee is involuntarily terminated, his/her personnel records must be retained for one year from the date of termination.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.