Loading

Get Ea Form 512 E

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EA Form 512 E online

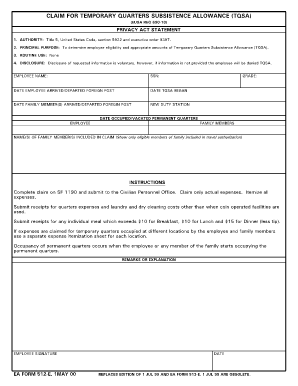

The EA Form 512 E is essential for claiming Temporary Quarters Subsistence Allowance (TQSA). This guide will provide clear, step-by-step instructions on how to complete the form online to ensure a successful claim.

Follow the steps to fill out the EA Form 512 E online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the form by entering your name, social security number (SSN), and the date you arrived or departed the foreign post.

- Input the date when the TQSA began, as well as the date your family member(s) arrived or departed the foreign post.

- Specify your grade and the new duty station where you will be or are currently assigned.

- Document the date you occupied or vacated your permanent quarters.

- List the names of any eligible family members included in the TQSA claim, ensuring they are only those specified in your travel authorization.

- For claiming expenses, complete the SF 1190 form and prepare to submit it to the Civilian Personnel Office. Ensure you only claim actual expenses and itemize all expenses.

- Attach receipts for lodging expenses and laundry or dry cleaning costs, unless using coin-operated facilities.

- If you while located at different places, use a separate itemization sheet for each temporary location.

- Record all meal costs, indicating the number of persons and the type of meal (e.g., breakfast, lunch, dinner). Include tips where applicable.

- Complete the daily itemization of TQSA expenses, detailing lodging and meal costs for each day.

- Add your signature and date at the end of the form to certify the accuracy of your submitted claim.

- At the final stage, users can save changes, download, print, or share the completed form as needed.

Complete the EA Form 512 E online today to facilitate your TQSA claim.

Every corporation organized under the laws of this state, or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue or creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.