Loading

Get Maryland Form 4b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maryland Form 4b online

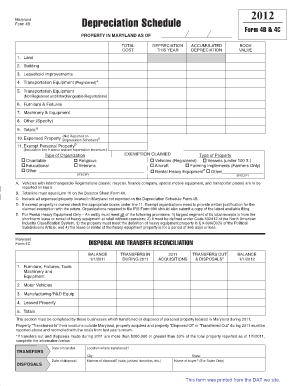

Completing the Maryland Form 4b online can assist users in accurately reporting depreciable property as required. This guide provides straightforward instructions for effectively navigating each section of the form, ensuring all necessary information is included.

Follow the steps to complete the Maryland Form 4b online

- Press the ‘Get Form’ button to access the Maryland Form 4b and open it in your preferred online editing tool.

- Begin by entering the property details for Maryland as of the specified date, providing the total cost for each property type listed.

- For each category such as land, buildings, and transportation equipment, fill in the current year's depreciation and accumulated depreciation, resulting in the book value for the property.

- Ensure to specify any other property types that do not fit the common categories in the 'Other (Specify)' section, providing relevant details.

- Complete the totals section (line 9) ensuring the total amount matches line 10 from the Balance Sheet Form 4A.

- If applicable, report any expensed property in line 10 that is located in Maryland but not included in the Depreciation Schedule.

- In line 11, indicate any exempt personal property and check the boxes for the type of organization and property to claim the exemption. Be prepared to provide justification if required.

- Upon completing all sections, review your form for accuracy, then save changes, download the completed form, or print it out for your records.

Begin filling out your Maryland Form 4b online today to ensure compliance and accuracy.

The employee claims "exempt" as a result of having no tax liability for the preceding tax year, expects to incur no liability this year, and the wages are expected to exceed $200 a week (a new exemption certificate must be re-filed each year by the 15th day of February for employees whose income tax liability is ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.