Loading

Get Cbt 200 T

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cbt 200 T online

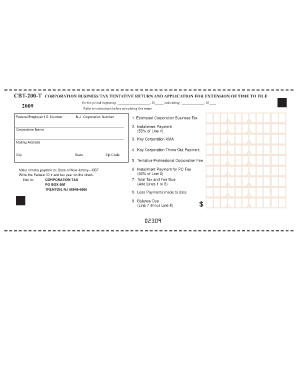

The Cbt 200 T form is essential for corporations in New Jersey to report their business tax and request an extension of time to file. This guide provides comprehensive instructions for each section of the form to ensure accurate and efficient completion.

Follow the steps to successfully complete the Cbt 200 T form online.

- Press the ‘Get Form’ button to access the Cbt 200 T and open it in your designated editing tool.

- In the section labeled 'Federal Employer I.D. Number,' input your federal ID. This number is critical for identification purposes.

- Fill in the 'period beginning' and 'ending' fields with the appropriate dates for your tax reporting period.

- Enter your N.J. Corporation Number in the designated field to confirm your registration with the state.

- Move to the 'Estimated Corporation Business Tax' section and input your calculated estimated tax amount.

- Calculate and provide the installment payment (50% of Line 1) in the 'Installment Payment' section.

- Include the key corporation AMA in its respective field to further specify your corporation details.

- Similarly, provide the key corporation throw-out payment and the tentative professional corporation fee.

- If applicable, input your installment payment for the PC fee (50% of Line 5).

- Sum the totals from Lines 1 to 6 and enter the final amount in the 'Total Tax and Fee Due' section.

- Record any payments made to date in Line 8 to track your financial obligations.

- Finally, calculate the balance due by subtracting Line 8 from Line 7.

- Once all fields are correctly filled, you can save your changes, download, print, or share the completed form as needed.

Start filling out your Cbt 200 T form online today to ensure timely compliance.

The deadline to file and pay New Jersey Income Taxes is extended to July 15, 2020. Visit our Covid-19 page for a list of extended filings. If you need more time to prepare your tax return, beyond the due date of July 15, you may apply for an extension of time to file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.