Loading

Get Simplified Worksheet 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Simplified Worksheet 2019 online

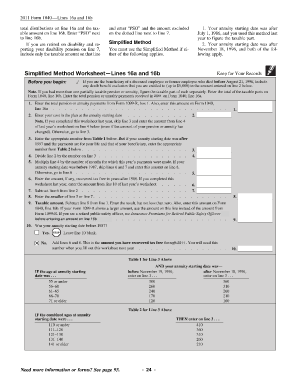

The Simplified Worksheet 2019 is an essential tool for accurately reporting pension and annuity distributions. This guide will assist you in navigating the process of filling out the form online, ensuring you complete it correctly and efficiently.

Follow the steps to complete the Simplified Worksheet 2019 online.

- Press the ‘Get Form’ button to access the Simplified Worksheet 2019 and open it in your editor.

- Begin by entering your total pension or annuity payments from Form 1099-R, box 1 into the designated field. Ensure this amount is also reflected on the appropriate line of your main tax return form.

- Next, calculate the taxable amount by subtracting the cost in the plan at the annuity starting date from the total payments. Record this value on the corresponding line as required.

- Refer to the appropriate tables provided in the worksheet to determine necessary values based on your annuity starting date and inputs. This helps in completing any calculations needed for the taxable amount.

- Proceed to fill out the remaining fields based on your calculated figures and follow any additional instructions provided in the worksheet.

- Once you have completed all sections, review the information for accuracy to ensure all entries correctly represent your financial situation.

- Finally, save your changes, and you may choose to download, print, or share the completed form based on your needs.

Get started on completing your Simplified Worksheet 2019 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

50% of W-2 wages paid by that trade or business to generate the QBI, or if greater, 25% of W-2 wages paid by the trade or business plus 2.5% of the unadjusted basis of the qualified property used by the trade or business.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.