Loading

Get Mileage Log Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mileage Log Form online

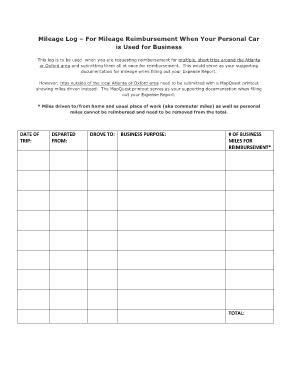

Filling out the Mileage Log Form accurately is essential when seeking reimbursement for business-related mileage. This guide offers clear, step-by-step instructions to effectively complete the form online.

Follow the steps to successfully complete your Mileage Log Form.

- Click ‘Get Form’ button to obtain the Mileage Log Form and open it in the appropriate editor.

- Enter the date of each trip in the designated field. This information helps track when the mileage was incurred.

- Fill in the 'Departed From' section with the starting location for each trip, ensuring clarity on where the trip began.

- In the 'Drove To' field, specify the destination for each trip to provide details on where you traveled for business purposes.

- State the business purpose of each trip in the corresponding section. This explanation is important for validating the necessity of the travel.

- Calculate and input the total number of business miles driven for reimbursement in the '# of Business Miles for Reimbursement' field, ensuring to exclude commuter and personal miles.

- Once all the information is correctly filled out, you can save your changes, download, print, or share the completed form as needed to support your expense report.

Start filling out your Mileage Log Form online today to ensure timely reimbursement!

Start Excel and select the "File" tab. ... Enter trip details. ... Enter odometer readings from the beginning and end of your trip. ... Add fields. ... Change the appearance of the worksheet. ... Calculate mileage reimbursements if the template does not do so. ... Calculate other expenses, if desired.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.