Loading

Get Form 8916

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8916 online

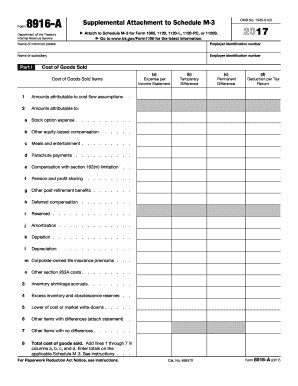

Form 8916 is an important document used to provide a detailed schedule for amounts reported on the applicable Schedule M-3 related to cost of goods sold, interest income, and interest expense. This guide will help you navigate the process of completing the form online.

Follow the steps to fill out the Form 8916 online.

- Use the ‘Get Form’ button to access the form and open it in your editor.

- Begin by entering the name of the common parent and the corresponding Employer Identification Number (EIN) at the top of the form.

- In Part I, 'Cost of Goods Sold', fill in the relevant expenses per income statement in column (a) and provide temporary and permanent differences in columns (b) and (c) respectively.

- Continue through Part I by providing details for each item, such as amounts attributed to stock options and pensions, making sure to complete all applicable sections and totals.

- Proceed to Part II where you will report all interest income. Ensure you fill in columns for tax-exempt income and differentiate between hybrid securities as required.

- Move to Part III for interest expense, entering details regarding interest from hybrid securities and intercompany transactions with the correct divisions into the respective columns.

- Review the completed sections to ensure accuracy and completeness, addressing any discrepancies or missing information as needed.

- Finally, save your changes to the document, and choose the option to download, print, or share the filled-out form based on your needs.

Complete your Form 8916 online today for streamlined filing.

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.