Loading

Get Form Gr 1040es Eft

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Gr 1040es Eft online

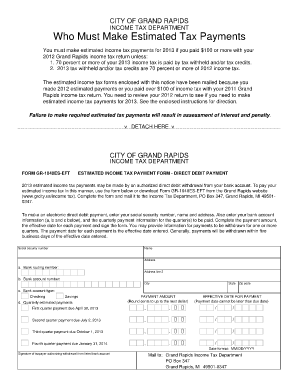

Filling out the Form Gr 1040es Eft online can simplify the process of making estimated income tax payments. This guide provides a step-by-step approach to ensure that you accurately complete each section of the form.

Follow the steps to successfully complete your Form Gr 1040es Eft.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number in the designated field. This information is crucial for identification purposes and processing your payment.

- Next, fill in your full name and address. Ensure that the address is current, as this will be used for correspondence regarding your estimated tax payments.

- Provide your bank account details, including the bank routing number and account number. Specify the type of bank account (checking or savings) by selecting the appropriate option.

- Input the quarterly estimated payment amounts. Round cents to the next dollar as per the guidelines. Include the effective payment dates for each quarter. Ensure the payment dates do not exceed the due dates.

- Review all the entered information for accuracy. It is essential to make sure that every section is filled out correctly to avoid delays or penalties.

- Once you have verified all the details, sign the form to authorize the direct debit withdrawal from your listed bank account.

- After completing the form, you can save changes, download the completed document, or print it for your records. Finally, mail the form to the Grand Rapids Income Tax Department at the address provided.

Complete your Form Gr 1040es Eft online to ensure timely and accurate estimated tax payments.

Go to IRS.gov/account. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax. Using the Electronic Federal Tax Payment System (EFTPS) is the easiest way for individuals as well as businesses to pay federal taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.