Loading

Get 2012 Ri-1120c - Rhode Island Division Of Taxation - Tax Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 RI-1120C - Rhode Island Division Of Taxation - Tax Ri online

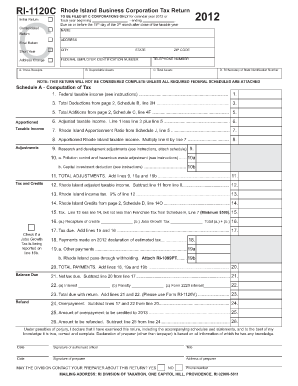

Completing the 2012 RI-1120C form is essential for C corporations operating in Rhode Island, ensuring compliance with state tax laws. This guide provides step-by-step instructions to assist users in accurately filling out the form online.

Follow the steps to effectively complete your tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your name and address at the top of the form, along with your federal employer identification number. Ensure that all these details are accurate, as they are crucial for your tax records.

- Indicate whether this is an initial return, final return, or short year return by checking the appropriate box. This is important for determining the tax obligations.

- Under Schedule A, input federal taxable income on line 1. Follow the instructions to attach all required federal schedules as indicated on the form.

- Detail your total deductions on line 3, which should include figures gathered from Schedule B and any supporting documents.

- For line 5, enter your total additions based on Schedule C, ensuring all necessary documentation is attached.

- Calculate the adjusted taxable income by subtracting line 3 from line 1 and adding line 5, then place the result on line 6.

- On line 7, enter your Rhode Island apportionment ratio obtained from Schedule J, and multiply it by the adjusted taxable income to find the apportioned Rhode Island taxable income for line 8.

- Complete lines 9 to 17, which include entering adjustments, calculating the Rhode Island income tax, and determining the total tax due after credits.

- Finally, review all information for completeness and accuracy. Once satisfied, you can save changes, download, print, or share the form as needed.

Complete your 2012 RI-1120C tax return online today to ensure timely and accurate filing.

401.574. 8967 or Crystal.Cote@tax.ri.gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.