Loading

Get Usda Assumption Truth In Lending Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Usda Assumption Truth In Lending Form online

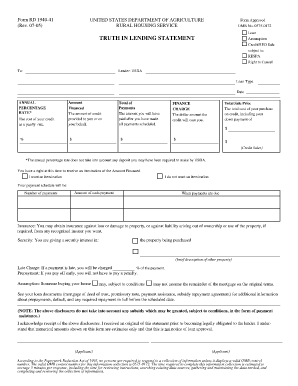

Filling out the Usda Assumption Truth In Lending Form online is an important step in managing your loan. This guide will provide you with clear instructions to help you successfully complete the form, ensuring you understand each section and its requirements.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields, including your name and contact details as the applicant.

- Next, specify the lender's name (USDA) and the loan type in the appropriate sections of the form.

- Fill out the date field with the current date of application.

- Enter the annual percentage rate in the specified field, ensuring it reflects your agreed-upon interest rate.

- Indicate the amount financed, which is the total credit provided to you, in the corresponding box.

- Provide the total of payments you will make over the course of the loan in the specified field.

- Fill in the total sale price, which includes the purchase price along with any additional down payment.

- Complete the finance charge section, which shows the total amount of credit costs.

- Select whether you want an itemization of the amount financed by checking the appropriate box.

- Outline your payment schedule, including the number of payments, the amount of each payment, and the due dates.

- Discuss insurance options briefly, indicating you may obtain insurance from any recognized insurer required for the property.

- Specify the security interest you are giving on the property being purchased in the related section.

- Indicate any late charge percentage applicable if a payment is made late.

- Note that there is no penalty for prepayment and outline the terms regarding loan assumption.

- Finally, acknowledge receipt of the disclosures by providing your signature in the designated spaces for applicants.

- After completing the form, review all entered information for accuracy, then save changes, download, print, or share the form as needed.

Complete your documents online today to ensure your loan process is simplified and efficient.

A Truth-in-Lending Disclosure Statement provides information about the costs of your credit. Your Truth-in-Lending form includes information about the cost of your mortgage loan, including your annual percentage rate (APR). ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.