Loading

Get Irs Form 8903 For 2010

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8903 for 2010 online

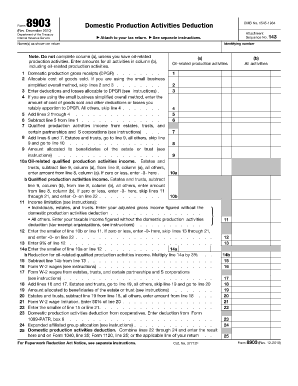

Filling out the IRS Form 8903 for 2010 can seem daunting, but with thorough guidance, you can complete it accurately online. This form is used to claim the domestic production activities deduction, and it's essential to understand each section to ensure you benefit fully from the deductions available.

Follow the steps to complete the IRS Form 8903 for 2010 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter your identifying number and the names as shown on your tax return. Ensure this information is accurate to maintain consistency with your records.

- Proceed to fill in line 1 by entering the domestic production gross receipts (DPGR) from all applicable activities.

- For line 2, if you are not using the small business simplified overall method, enter the allocable cost of goods sold. If you are, skip this line and move to line 5.

- On line 3, enter any deductions and losses that are allocable to the DPGR. You will need to refer to the instructions if you are unsure about which deductions apply.

- If applicable, move to line 4 and enter the cost of goods sold and other deductions, apportioning them to the DPGR. Once done, add lines 2 through 4 for line 5.

- Line 6 requires you to subtract the total from line 5 from your DPGR entered on line 1, reflecting your adjusted production activities income.

- Line 7 asks for qualified production activities income from certain estates, trusts, and partnerships, which you should input if relevant.

- Sum the results of lines 6 and 7 for line 8. If you are completing this for an estate or trust, you will need to complete line 9 after this.

- For line 10a and 10b, calculate the oil-related qualified production activities income and the other qualified production activities income, entering the respective amounts based on your findings.

- Enter your income limitation on line 11, ensuring that you follow the instructions provided to determine the accurate figure based on your adjusted gross income or taxable income.

- Complete line 12 with the smaller amount between line 10b or line 11, and if zero or less, enter -0-.

- You’ll enter calculations for lines 13 through 22 based on your responses, focusing on calculating wages and determining the domestic production activities deduction.

- Once all lines are filled out, review the form for accuracy and completeness. You can then save your changes, download, print, or share the completed form as needed.

Start completing your IRS Form 8903 online today to maximize your deductions.

The DPAD is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the product.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.