Loading

Get 2011 Rct 101 Form Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Rct 101 Form Fillable online

Filling out the 2011 Rct 101 Form Fillable online can streamline your corporate tax reporting process. This guide offers detailed, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Rct 101 form online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

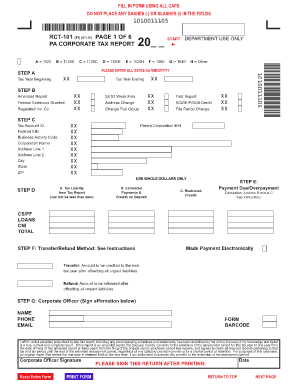

- Begin by entering the required information in Section A. You will need to input the tax year beginning and ending dates in MMDDYYYY format. Make sure there are no dashes or slashes in the fields.

- In Step B, indicate whether this is an amended report, if a federal extension was granted, and if this is a first report. Carefully mark any other relevant selections.

- Provide your tax account ID, federal EIN, business activity code, corporation name, and address details in Step C. Ensure that all entries are in uppercase as specified.

- Calculate tax liability and record it in Step D. Provide information on estimated payments and restricted credits accurately. Ensure you are using whole dollars only.

- Next, in Step E, determine your payment due or overpayment by calculating A minus B minus C, following the instructions provided.

- In Step F, select your preferred method for transfer or refund based on the provided options.

- Complete Section G by providing the corporate officer's name, phone, and email for affirmation. Sign and date the form where required.

- Finally, save changes to your filled form, and choose to download, print, or share it as needed.

Ready to complete your tax forms? Access and fill out your documents online today!

The RCT-101 should be mailed to: If payment is due with the RCT-101 PA Dept of Revenue Payment Enclosed P.O. Box 280427 Harrisburg, PA 17128-0427 If requesting a refund or transfer of credit PA Dept...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.