Loading

Get Department Of Treasury Form 5695

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Department Of Treasury Form 5695 online

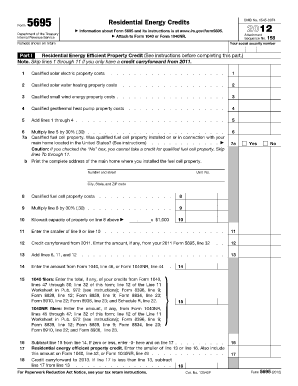

Filling out the Department Of Treasury Form 5695 is essential for claiming residential energy credits. This guide provides a clear, step-by-step approach to help you complete the form online with confidence.

Follow the steps to fill out Form 5695 accurately.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- Begin by providing your name or the names of all individuals listed on your tax return, alongside your social security number, at the top of the form.

- In Part I, address the Residential Energy Efficient Property Credit: If you made energy improvements in 2012, you will need to fill out lines 1 through 5 for qualified costs regarding solar electric property, solar water heating property, small wind energy property, and geothermal heat pump property.

- Multiply the total from line 5 by 30% to calculate your credit on line 6.

- If you have qualified fuel cell property, answer the question on line 7a regarding installation at your main home. If Yes, provide the address on line 7b and complete line 8 with your costs.

- Add any other credits from line 13 to ascertain the total credits you can claim on line 14.

- Proceed to Part II for Nonbusiness Energy Property Credit: Confirm that the improvements were made on your main home and record costs associated with energy efficiency measures in lines 20 and 21.

- Calculate the total credits in Part II and check limits as necessary. Complete the final sections of the form.

- After completing the form, review all entries for accuracy before saving your changes, downloading, or printing the document for submission.

Complete your Department Of Treasury Form 5695 online to ensure you don't miss out on potential energy credits!

You may be entitled to a tax credit of up to $500*** if you installed energy-efficient windows, skylights, doors or other qualifying items in 2018-2020**. Federal tax credits for certain energy-efficient improvements to existing homes have been extended through December 31, 2020.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.