Loading

Get City Of Walker Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Walker Fillable Form online

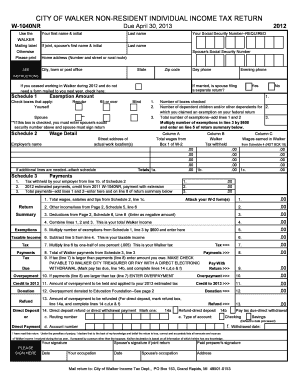

Filling out the City Of Walker Fillable Form requires a clear understanding of the components involved in the form. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the City Of Walker Fillable Form successfully.

- Click ‘Get Form’ button to obtain the form and open it in your browser or preferred online editor.

- Begin with the personal information section at the top of the form. Enter your first and last name, Social Security number, and contact details, including your home address and phone numbers.

- Move to Schedule 1, where you will claim exemptions. Indicate any applicable exemptions such as age or blindness.

- Proceed to Schedule 2, the Wage Detail. Fill in the employer's name and total wages earned as per your W-2 forms. Ensure accuracy when entering these amounts.

- Complete Schedule 3 to document payments made or withheld. Input the amounts from your W-2. Verify that those amounts match the documentation you are submitting.

- If applicable, fill out Schedule 4 to allocate wages earned inside and outside of Walker. This requires accurate logging of days worked at each location.

- Continue to Schedule 5 for reporting any other income or loss. Attach any necessary schedules if required, such as Federal Schedules C or D.

- Complete Schedule 6 for deductions relevant to your Walker income. Attach any relevant documents supporting your deductions.

- After completing necessary schedules, return to the main form to summarize your income and payments. Carefully calculate your taxable income and overpayment.

- Finally, review all entered information for accuracy. Save your changes, and consider downloading, printing, or sharing the completed form as necessary.

Start filling out the City Of Walker Fillable Form online now to ensure timely submission.

You will need to file if you lived in the city during any part of the tax year and had taxable income. If you did not live in the city, but earned taxable income from within city limits you will also need to file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.