Loading

Get Cr Q3 Form 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cr Q3 Form 2014 online

This guide will provide you with step-by-step instructions on completing the Cr Q3 Form online. Whether you are familiar with digital documents or new to this type of filing, this comprehensive guide aims to make the process straightforward and supportive.

Follow the steps to accurately complete the Cr Q3 Form online.

- Click ‘Get Form’ button to obtain the Cr Q3 Form and open it in the editor.

- Enter the address, zip code, and block and lot number for each taxable premises where your annualized gross rent exceeds $200,000. You can find the block and lot number on the Department of Finance website or from your landlord.

- Determine and enter the amount of gross rent paid for each premises. If your rent includes a percentage based on sales receipts, only enter the portion that does not exceed 15% of those receipts.

- If applicable, indicate the portion of the rent that is attributable to residential use only, if the premises are being rented for both business and residential purposes.

- List any rent amounts received from subtenants, including their identifying information, and ensure you only deduct subtenant rents from the gross rent of the specific premises occupied by those subtenants.

- Complete the deductions section by listing other eligible deductions attached on a separate schedule, if necessary.

- Calculate your base rent before any reductions by subtracting the total deductions from the gross rent paid.

- Apply the 35% rent reduction to your calculated base rent to determine the amount subject to tax.

- If your lease period is less than three months, provide the duration of occupancy and annualize the rent for the reporting period.

- Complete the computation for tax due by multiplying your base rent subject to tax with the applicable tax rate.

- Review your entries for any corrections or omissions. Once completed, save the changes, download, print, or share the form as needed.

Complete your documents online to ensure timely and accurate submissions.

Related links form

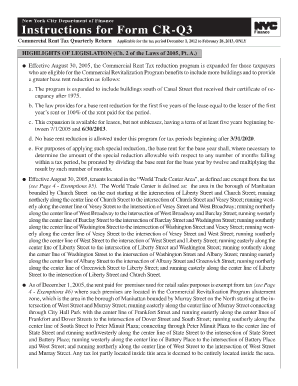

The CRT is imposed at an effective rate of no more than 3.9% on rent paid by affected tenants. The actual amount of tax may be less than 3.9% of total rent paid if the rent is less than $300,000 or if the tenant's total income is less than $10 Million.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.