Loading

Get Mochigan Form 1040x

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mochigan Form 1040x online

Filing an amended income tax return can be a straightforward process with the right guidance. This guide provides a user-friendly approach to filling out the Mochigan Form 1040x online, ensuring you have all the necessary information to accurately amend your tax return.

Follow the steps to successfully complete your Mochigan Form 1040x online.

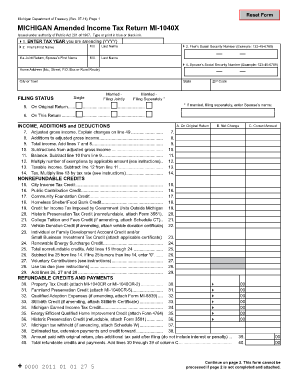

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the tax year you are amending in the designated field. Make sure to use the correct format (YYYY) and ensure this is accurate, as it is essential for processing your return.

- Fill in your last name and first name along with the middle initial. If you are filing jointly, also include your partner's first name and middle initial.

- Provide the Social Security Numbers (SSN) for both yourself and your partner if applicable. Remember to follow the example format provided (e.g., 123-45-6789).

- Complete your home address with details such as street number, city, state, and ZIP code.

- Select your filing status. Choose from options like 'Single,' 'Married Filing Jointly,' or 'Married Filing Separately'. If married and filing separately, enter your spouse's name.

- In the income section, enter your adjusted gross income from the original return as well as any changes. Be sure to explain these changes in the explanations section.

- Fill out any deductions and additions to adjusted gross income, ensuring each line is accurately completed.

- Calculate and enter your total income and any applicable nonrefundable credits.

- Complete the residency status section, indicating whether you are a resident, non-resident, or part-year resident, and provide residency dates if necessary.

- List all dependents and answer the relevant questions about each one, ensuring to attach any additional sheets if necessary.

- In the explanations section, provide a detailed explanation for any changes made in your return. This is important to avoid processing delays.

- Review all entered information for accuracy and completeness. Confirm that all necessary signatures are included.

- Once finished, save your changes. You can then download, print, or share your completed form as needed.

Complete your documents online today to ensure your amended return is filed accurately and on time.

You can include additional changes to your originally filed return on the Stimulus Payment Form 1040X. However, the only information that will be used to figure your stimulus payment amount is the information on your original return and the qualifying income you reported on this Form 1040X.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.