Loading

Get T1 Cra

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T1 CRA online

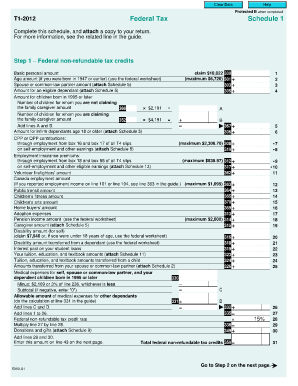

Completing the T1 CRA form online can simplify your tax filing process and ensure accuracy. This guide provides a comprehensive overview of the form's components and step-by-step instructions for filling it out effectively.

Follow the steps to complete the T1 CRA online.

- Press the ‘Get Form’ button to obtain the T1 CRA form and open it in your preferred document editor.

- Begin with Step 1, where you will calculate federal non-refundable tax credits. Input amounts as directed in the fields regarding basic personal amounts, age amounts, and other applicable credits.

- Identify your Employment Insurance premium contributions from T4 slips and enter them in the corresponding fields for additional deductions.

- List all medical expenses and eligible amounts for dependants under federal guidelines, ensuring to refer to the related schedules for accurate completion.

- Proceed to Step 2, where you will enter your taxable income from your return. Note the thresholds provided to determine your tax rate.

- Calculate your federal tax on taxable income by following the guidance for each income bracket, ensuring to account for any applicable deductions.

- In Step 3, summarize your total federal non-refundable tax credits and prepare to calculate your net federal tax by combining necessary amounts as directed.

- Once all fields and sections are completed, review your entries for accuracy and ensure compliance with tax guidelines.

- Save your changes, download, print, or share the completed T1 CRA form as needed.

Start filling out your documents online today for a smoother tax filing experience.

Related links form

The T1 General Income Tax and Benefit Return is the tax return used by individuals to calculate their annual tax liability and get federal or provincial benefits such as the GST/HST Credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.