Loading

Get Non Tax Filer Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non Tax Filer Application online

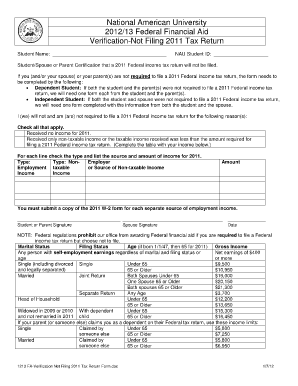

Completing the Non Tax Filer Application online is a straightforward process that ensures you provide the necessary information regarding your tax filing status. This guide walks you through each step to help you accurately fill out the form and submit it with confidence.

Follow the steps to complete the Non Tax Filer Application online.

- Press the ‘Get Form’ button to access the Non Tax Filer Application and open it in your preferred document editor.

- Begin by entering your name and National American University (NAU) Student ID at the top of the form. This information is crucial for identifying your application.

- Indicate whether you (and/or your spouse) or your parent(s) are required to file a 2011 Federal income tax return. This section helps determine the applicability of the form.

- Complete the additional table that asks for income details. Specify the type of income received and provide both the source and amount for each income entry.

- Sign and date the form where indicated. If applicable, ensure your spouse also provides their signature.

- Once completed, review the form for accuracy, save your changes, and choose to download, print, or share as needed.

Take the next step towards securing your financial aid by completing your Non Tax Filer Application online today.

Related links form

Online. Mailing in a form. Make an appointment at your local taxpayer assistance center.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.