Loading

Get 2013 Instructions For Form 1099-misc - Internal Revenue Service - In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Instructions For Form 1099-MISC - Internal Revenue Service - In online

Filling out Form 1099-MISC correctly is essential for reporting payments made in the course of business. This guide will provide you with clear and concise steps to complete the 2013 instructions for the form online, ensuring that all necessary information is accurately captured.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

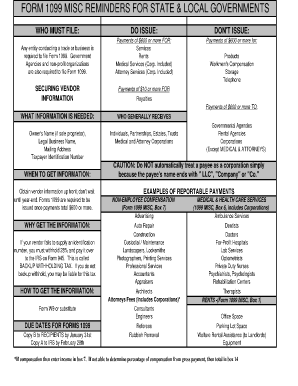

- Review the filing requirements. Ensure that you are filing if you have made payments of $600 or more to any entity conducting a trade or business, including government agencies and non-profit organizations.

- Gather necessary vendor information, which includes the owner's name (if a sole proprietor), legal business name, mailing address, and taxpayer identification number (TIN). It is recommended to obtain this information before processing payments.

- Determine the types of payments that are reportable on Form 1099-MISC. Payments for services, rents, medical services, and attorney services that total $600 or more require reporting.

- Complete the form by filling out the appropriate boxes with the gathered information. Pay special attention to which payments belong in Box 1 (rents), Box 6 (medical and health care services), and Box 7 (non-employee compensation).

- Review your entries for accuracy. Ensure that all required information is complete and correct to avoid penalties.

- Finalize the document. Once satisfied with the completed form, save changes, download, print, or share the form as necessary.

Act now to start filling out your documents online for efficient processing.

Related links form

Generally, the income on this form is subject to federal income tax and state income tax. The IRS requires those that pay nonemployee compensation income in the course of their trade or business to issue Form 1099-NEC to their payees and requires the payees to include these payments on their tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.