Loading

Get Idaho 910 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idaho 910 Form online

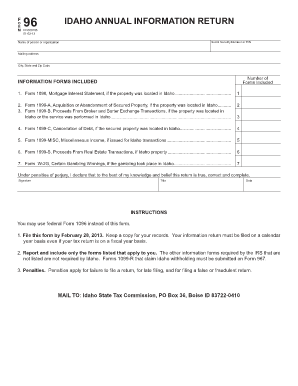

The Idaho 910 Form is an essential document for reporting annual information returns to the Idaho State Tax Commission. This guide provides step-by-step instructions for successfully completing the form online, ensuring that users have a clear understanding of its components and requirements.

Follow the steps to fill out the Idaho 910 Form online.

- Click ‘Get Form’ button to obtain the Idaho 910 Form and open it in your chosen online editor.

- Begin by entering your Social Security Number or Employer Identification Number (EIN) in the designated field. This identifies your submission to the tax authorities.

- Fill in the name of the person or organization that is submitting the form. Ensure that the name matches any legal documents.

- Next, provide the mailing address, including the city, state, and zip code. Double-check to ensure all information is accurate.

- Indicate the number of forms included in your submission. This refers to the total number of related information forms being filed.

- List each of the included forms in the sections provided on the form. Include Form 1098, 1099-A, 1099-B, 1099-C, 1099-MISC, 1099-S, and W-2G as applicable to your situation.

- Declare the completeness and accuracy of your return by signing in the designated space, providing your title, and entering the date of signing.

- Once all fields are completed, review your entries for accuracy. Save changes, and then download the form, print, or share it as needed.

Complete your Idaho 910 Form online today for a smoother filing experience.

Related links form

If your income is less than your standard deduction, you generally don't need to file a return (provided you don't have a type of income that requires you to file a return for other reasons, such as self-employment income).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.