Loading

Get Md Wh-ar 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD WH-AR online

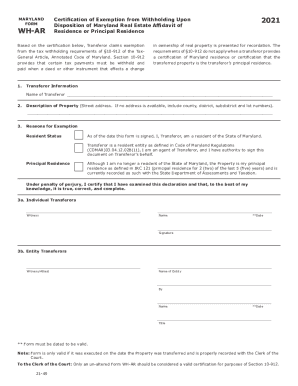

The MD WH-AR form, also known as the Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate, is a document intended for individuals looking to certify their exemption from tax withholding when transferring real property. This guide provides step-by-step instructions to assist you in completing the form online, ensuring clarity and accuracy throughout the process.

Follow the steps to fill out the MD WH-AR online.

- Click the ‘Get Form’ button to access the MD WH-AR form, which you can then open in the editing interface.

- Begin by providing your personal details in the 'Transferor Information' section, including the full name of the transferor.

- Next, fill in the 'Description of Property' field. This involves entering the street address of the property. If an address is not available, include the county, district, subdistrict, and lot numbers.

- In the 'Reasons for Exemption' section, indicate your resident status by checking the appropriate option. Confirm whether you are a resident of Maryland or if the property is your principal residence.

- If applicable, as an individual transferor, enter the name of the witness along with their signature and the date on which the form is signed.

- For entity transferors, provide the name of the entity and the authorized person’s name, signature, title, and date.

- Before concluding, ensure that all parts of the form are completed accurately and that any required signatures are included. Save your changes, then proceed to download, print, or share the completed form as necessary.

Complete your documents online today to ensure a smooth property transfer process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

By law, tax must be withheld from the total payment on any sale of Maryland real property sold by a nonresident. The funds are withheld as an estimated payment on your behalf to cover any possible tax implications incurred as a result from a gain on the sale.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.