Loading

Get Workers Comp Exemption Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Workers Comp Exemption Form online

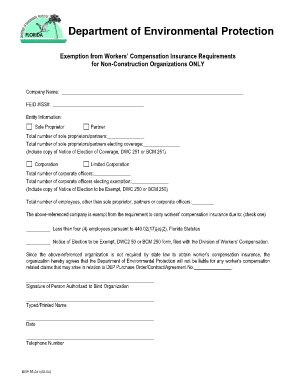

Filling out the Workers Comp Exemption Form online can seem daunting, but this guide provides clear instructions to help you through each section of the form. Whether you are a sole proprietor, partner, or part of a corporation, following the steps outlined will ensure you complete the form correctly.

Follow the steps to complete the Workers Comp Exemption Form online:

- Click ‘Get Form’ button to obtain the Workers Comp Exemption Form and open it in the editing interface.

- Begin by entering the company name and federal employer identification number (FEID) or social security number (SS#) in the designated fields.

- Select the type of entity by checking the appropriate box for 'Sole Proprietor', 'Partner', 'Corporation', or 'Limited Corporation'.

- If you selected 'Sole Proprietor' or 'Partner', specify the total number of sole proprietors/partners and the number electing coverage.

- For 'Corporation' or 'Limited Corporation', indicate the total number of corporate officers and how many are electing exemption.

- Enter the total number of employees, other than sole proprietors, partners, or corporate officers in the provided space.

- Indicate the reason for exemption by checking one of the boxes. Options include having less than four employees or having filed a Notice of Election to be Exempt.

- Provide the signature of the person authorized to bind the organization, along with their typed/printed name, date, and telephone number.

- Once all required fields are completed, make sure to save any changes, and then download, print, or share the form as needed.

Complete your Workers Comp Exemption Form online today to ensure compliance and protection.

To be exempt from worker's compensation, you must submit an affidavit, certifying that you do not employ anyone in a manner that is subject to the workers' compensation laws of California. (See Business and Professions Code Section 7125.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.