Loading

Get 1099 Form Layout

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Form Layout online

The 1099 Form Layout is essential for reporting various types of income to the Internal Revenue Service (IRS). This guide offers clear, step-by-step instructions for completing the 1099 Form online, helping users navigate the necessary fields with confidence.

Follow the steps to effectively complete the 1099 Form Layout.

- Click ‘Get Form’ button to access the 1099 Form Layout and open it in your preferred document editor.

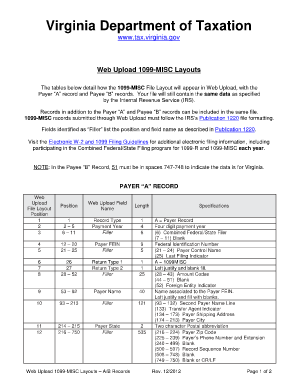

- Start with the Payer 'A' record. Enter the payer's federal identification number (FEIN) in the designated field. Ensure you follow the specified field length.

- Fill in the payment year correctly. This should be a four-digit number that reflects the year of payment.

- Complete the payer’s name and address, ensuring all fields are left-justified and blanks are filled appropriately as needed.

- Move on to the Payee 'B' record. Enter the payee's tax identification number (TIN) and ensure it is nine digits long.

- Fill in the payee's name, ensuring it follows the required formatting guidelines. Include additional payment details for each amount as listed in the form.

- Verify all entered data for accuracy. Ensure compliance with any state-specific requirements, particularly for the state income tax withheld.

- Once the form is complete, save your changes. You can choose to download, print, or share the completed form as needed.

Complete your 1099 Form Layout online for accurate tax reporting today.

The IRS taxes 1099 contractors as self-employed. If you made more than $400, you need to pay self-employment tax. Self-employment taxes total roughly 15.3%, which includes Medicare and Social Security taxes. Your income tax bracket determines how much you should save for income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.