Loading

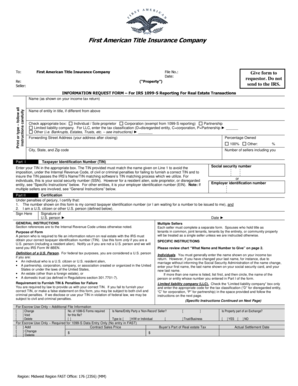

Get Information Request Form For Irs 1099 S Reporting For Real Estate Transactions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Information Request Form For IRS 1099-S Reporting For Real Estate Transactions online

Filling out the Information Request Form for IRS 1099-S Reporting for real estate transactions is a crucial step for individuals and entities involved in selling real estate. This guide offers a clear, step-by-step approach to completing the form online, ensuring your information is accurately submitted.

Follow the steps to successfully complete the IRS 1099-S reporting form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your name as it appears on your income tax return in the designated field. If the title is held by an entity, provide the entity's name in the next box.

- Select the appropriate box indicating your filing status: Individual/Sole Proprietor, Corporation (exempt from 1099-S reporting), Partnership, Limited Liability Company (LLC), or Other. For an LLC, specify the tax classification.

- Indicate the percentage ownership in the property by entering the appropriate value.

- Fill out your forwarding street address, which is where you will receive correspondence after closing.

- Provide your Taxpayer Identification Number (TIN) in the appropriate box. Make sure it matches the name provided to avoid any penalties.

- Complete the certification section by signing the form and dating it. Ensure that you certify your U.S. person status as required.

- Once all fields are accurately completed, you may save changes, download the form for your records, or print it for submission.

Begin filling out the Information Request Form for IRS 1099-S Reporting for real estate transactions online today.

Box 2.Gross proceeds means any cash received or to be received for the real property by or on behalf of the transferor, including the stated principal amount of a note payable to or for the benefit of the transferor and including a note or mortgage paid off at settlement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.