Loading

Get 592 F 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 592 F 2012 Form online

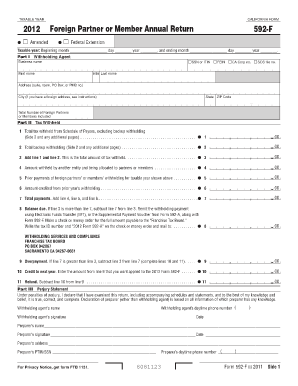

The 592 F 2012 Form is crucial for foreign partners or members to report withholding taxes in California. This guide provides clear, step-by-step instructions on completing this form online, ensuring your submission is accurate and compliant with state requirements.

Follow the steps to complete the 592 F 2012 Form online easily.

- Click ‘Get Form’ button to access the 592 F 2012 Form and open it in your preferred editor.

- Enter the taxable year at the top of the form. Specify the beginning and ending months and year.

- In Part I, provide information about the withholding agent, including their business name, identification number (e.g., SSN, FEIN), and complete address.

- Indicate the total number of foreign partners or members included in this submission.

- In Part II, begin by entering the total tax withheld from Schedule of Payees, excluding backup withholding.

- Next, report the total backup withholding amount.

- Calculate the total amount of tax withheld by adding the amounts from the previous two lines.

- Report any amounts withheld by another entity that allocated tax to foreign partners or members.

- Document prior payments made for withholding during the taxable year.

- Enter any amounts credited from prior year’s withholding.

- Total the payments by adding prior payments and credits.

- Calculate any balance due or overpayment based on the totals and indicate if you wish to apply any overpayment to the next year's form.

- Complete the Perjury Statement, including the withholding agent's and preparer's details.

- If applicable, attach additional schedules for each payee that received withholding payments, ensuring all requested information is completed accurately.

- Finally, review your entries for accuracy, then save your changes, download, print, or share the completed form as needed.

Complete and submit your 592 F 2012 Form online to ensure compliance and avoid penalties.

Form 592-B, Resident and Nonresident Withholding Tax Statement The withholding agent must provide Form 592-B, to each partner or member which shows the total amount withheld and reported for the taxable year. The withholding agent does not submit Form 592-B to the FTB.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.