Loading

Get 2012 Ohio Sd100 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Ohio Sd100 Form online

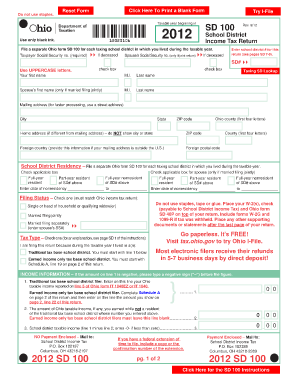

This guide provides clear instructions on how to fill out the 2012 Ohio Sd100 Form online. Whether you are a first-time filer or have previous experience, this step-by-step guide will help ensure you complete your tax return accurately and efficiently.

Follow the steps to complete your 2012 Ohio Sd100 Form online.

- Press the ‘Get Form’ button to access the 2012 Ohio Sd100 Form and open it in your designated text editor.

- Enter the taxable year, which should be 2012. Make sure to use only black ink for handwritten entries if applicable.

- Provide your Social Security number. If you are filing a joint return, include your partner’s Social Security number as well.

- Select the appropriate school district number for the current return by referencing the provided pages SD 7-8.

- Fill in your name and address details accurately. Remember to include your city, state, and ZIP code for the mailing address.

- Indicate your residency status by checking the applicable box. If filing jointly, do the same for your partner.

- Identify your filing status, ensuring it matches your Ohio income tax return. Options include Single, Married Filing Jointly, or Married Filing Separately.

- Provide your income information based on the specified lines in the form. Ensure accuracy in reporting your taxable income.

- Complete any additional sections, including schedules as needed, before reviewing the entire form for accuracy.

- Once completed, save your changes, and choose to download or print the form as needed. Be sure to share it with relevant parties if necessary.

Complete your 2012 Ohio Sd100 Form online now to ensure timely filing.

a) Any individual residing in the state of Ohio who lives during all or part of a tax year in a school district that levies the tax. A part-year resident must pay the SDIT based upon income received during the portion of the taxable year in which he/she is a resident of the school district that has enacted the tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.