Loading

Get 2004 California Exempt Organization Annual Information ... - Ftb.ca.gov - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 California Exempt Organization Annual Information Return online

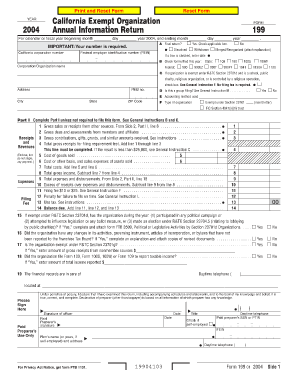

Completing the 2004 California Exempt Organization Annual Information Return is essential for maintaining compliance with state regulations. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete your annual information return.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter the organization’s name, federal employer identification number (FEIN), and California corporation number. Ensure that all details match the organization’s records.

- Indicate whether the organization is dissolved, withdrawn, or merged by checking the appropriate box and providing the relevant date if applicable.

- Select the forms that have been filed this year by marking the corresponding boxes for state and federal filings.

- Complete Part I by filling in the gross receipts information in the provided fields. Add any applicable gross sales, dues, contributions, and count the total gross receipts to determine filing requirements.

- Proceed to itemize expenses and total costs, ensuring to subtract line 7 from line 4 for total gross income.

- Fill in details regarding political or legislative activities, and indicate whether any changes occurred in the organization’s structure or activities.

- Review all entries for accuracy. Once finalized, save changes, and consider downloading or printing the completed form for your records.

- Submit the completed form as per the instructions provided in the guidelines, ensuring all necessary attachments are included.

Ensure your exempt organization remains compliant by completing the 2004 California Exempt Organization Annual Information Return online today.

Related links form

Exemption Application (Form 3500) Download the form. Determine your exemption type , complete, print, and mail your application. ... Submission of Exemption Request (Form 3500A) If you have a federal determination letter:

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.