Loading

Get Fillable Mt40

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Mt40 online

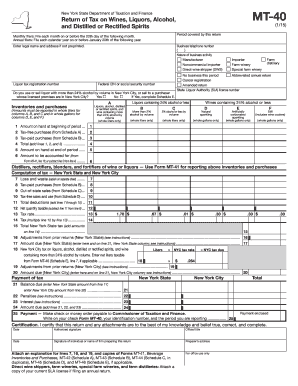

The Fillable Mt40 is an essential document for reporting taxes on wines, liquors, and spirits in New York State. This guide provides a clear, step-by-step approach to help users navigate each section of the form efficiently.

Follow the steps to complete the Fillable Mt40 online

- Press the ‘Get Form’ button to access the Fillable Mt40 and open it in your preferred digital editor.

- Begin by entering the period covered by your return. Include the legal name and address of your business in the designated fields, if not preprinted.

- Input your business telephone number in the appropriate field. Select the nature of your business activity by checking the relevant box for either Manufacturer, Noncommercial importer, or Direct wine shipper.

- Provide your liquor tax registration number and either your Federal EIN or social security number as required.

- Indicate whether you use or sell liquor with more than 24% alcohol by volume in New York City. If ‘Yes’, be sure to complete Schedule E as instructed.

- In the inventories and purchases section, record the amount on hand at the beginning of the period, tax-free purchases, tax-paid purchases, and calculate the total by adding these amounts.

- Fill in the amount on hand at the end of the period, and compute the amount to be accounted for by referring to Form MT-41 or subtracting the amount on hand at the end from the total amount.

- Complete the tax computation section by documenting loss and waste, tax-paid purchases, out-of-state sales, and tax-free sales and use. Add these deductions to find the total and determine the net quantity taxable.

- Calculate the tax due based on the net quantity taxable and record it in the appropriate field.

- Finish filling out any additional taxes and balances due. Make sure to include any adjustments from prior returns as applicable.

- Complete the payment section by indicating the total amount due and specifying your payment options. Ensure you include the necessary identifying information on any payment method used.

- Provide the certification by entering the date, authorized signature, and the signature of the individual or firm preparing the return.

- At the end of the form, make sure to attach relevant documents, including any necessary explanations and additional forms required.

- Save your changes, download, and/or print the filled form for your records. You can also share it if necessary.

Complete your Fillable Mt40 online today to ensure timely filing and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.