Loading

Get 2008 Form 588 - Nonresident Withholding Waiver Request - Ftb.ca.gov - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2008 Form 588 - Nonresident Withholding Waiver Request online

This guide provides clear, step-by-step instructions for completing the 2008 Form 588, which is used to request a waiver for nonresident withholding on California source income payments. Whether you are filling out this form for the first time or need a refresher, these simplified instructions aim to support your process.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to obtain the 2008 Form 588 and open it in your editing tool.

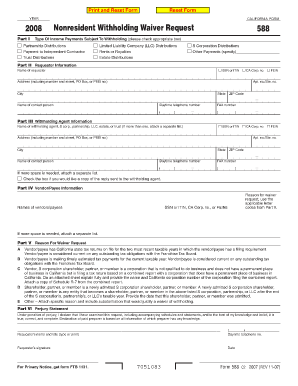

- Part I requires you to specify the type of income payments subject to withholding by checking the appropriate boxes. Options include partnership distributions, payments to independent contractors, trust distributions, LLC distributions, rents or royalties, estate distributions, and S corporation distributions.

- In Part II, fill out the requester information. Provide your SSN or ITIN, California corporation number, or FEIN. Input your name, address (including any PMB number if applicable), city, state, and ZIP code. Include a contact person's name and daytime telephone number.

- Part III asks for withholding agent information. Again, provide the necessary tax identification information (SSN, CA Corp. no., or FEIN) and address details for the withholding agent. If there are multiple withholding agents, attach a separate list.

- In Part IV, list the names of the vendors or payees that the waiver applies to, along with their respective SSN, ITIN, CA corporation number, or FEIN. Indicate the reason for the waiver request by citing the letter codes from Part V.

- Part V requires you to select the reason for your waiver request. Check the applicable letter codes, and if item E is chosen, ensure to provide additional information on a separate attachment.

- Complete Part VI by signing and dating the request. This declaration confirms that the information provided is true and complete to the best of your knowledge.

- Once you have filled out the form, you can choose to save the changes, download, print, or share the form as needed.

Take advantage of the ease of completing documents online; initiate your 2008 Form 588 now.

The State of California taxes its residents on all of their income, including income acquired from sources outside the state. Nonresidents are also subject to California income tax, but only on their California-source income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.