Loading

Get Form It-203-s-att: 2000, Group Return For Nonresident ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-203-S-ATT: 2000, Group Return For Nonresident ... - Tax Ny online

Filling out Form IT-203-S-ATT: 2000 is an essential step for nonresident shareholders of S corporations filing in New York. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently online.

Follow the steps to effectively complete your tax form online.

- Click ‘Get Form’ button to obtain the form and open it in your document editor.

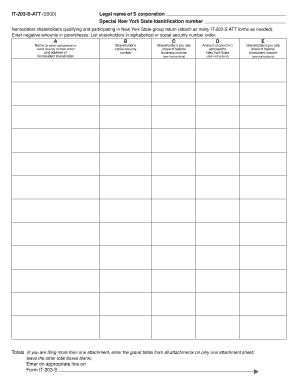

- Enter the legal name of the S corporation and the special New York State identification number in the designated fields at the top of the form.

- List all nonresident shareholders who qualify and are participating in the New York State group return. You may attach additional IT-203-S-ATT forms as necessary.

- In the shareholder section, fill in the names and social security numbers of the shareholders in either alphabetical order or by social security number.

- Provide each shareholder's pro rata share of federal business income in the corresponding column.

- Allocate the amount from column C to New York State and enter it in the appropriate column.

- Fill in the shareholder's pro rata share of federal investment income and allocate that amount to New York State.

- Calculate and enter the total of column D and column F (D + F) in the specified column.

- Record each shareholder’s pro rata share of federal S corporation deductions and allocate to New York State.

- Determine net amounts of New York additions and subtractions and record them as instructed.

- Calculate New York taxable income by subtracting column I from column G and adding or subtracting column J.

- Complete the calculation for New York State tax by multiplying column K by .0685.

- Enter the New York State estimated tax paid and the balance due or any overpayment in the corresponding areas.

- If you are filing more than one attachment, make sure to enter the grand totals from all attachments on only one attachment sheet and leave the other total boxes blank.

- Once you have completed the form, save your changes, and prepare to download, print, or share your form as needed.

Complete your tax documentation online today for a smooth filing experience.

What Is Taxable Income for Non-Residents? Nonresident aliens use Form 1040NR or 1040NR-EZ to report only income sourced in the United States, or effectively connected with a United States trade or business. Read more about "effectively connected income," and "Source of Income" by using the preceding links.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.