Loading

Get Nj Appointment Of Taxpayer Representative

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj Appointment Of Taxpayer Representative online

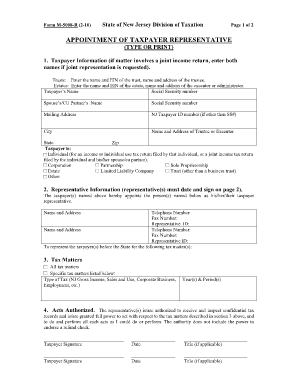

Filling out the Nj Appointment Of Taxpayer Representative is essential for designating someone to act on your behalf regarding tax matters in New Jersey. This guide provides clear, step-by-step instructions tailored to help you complete the form accurately and efficiently, even if you have little legal experience.

Follow the steps to successfully complete your Nj Appointment Of Taxpayer Representative online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editor.

- In the first section labeled 'Taxpayer Information', enter the name of the taxpayer and, if applicable, the spouse or partner’s information. Include social security numbers, mailing address, and NJ taxpayer ID number, if relevant. Ensure to provide details for estates or trusts if applicable.

- For the 'Representative Information' section, list the name, address, telephone number, fax number, and representative ID of your appointed representative and any additional representatives as needed.

- In the 'Tax Matters' section, indicate whether the appointment covers all tax matters or specify particular issues like gross income tax or sales and use tax. Also, include the relevant years or periods.

- Review the 'Acts Authorized' section, confirming that your representative can act on your behalf regarding tax matters. Note that they cannot endorse refund checks.

- Both taxpayers (if applicable) must sign and date the form in the 'Taxpayer Signature' section. If the appointment involves a joint return, ensure both parties sign.

- In the 'Notices and Communications' section, specify preferences for where notices and communications should be sent. You can choose not to send notices to your representatives or send copies to both listed representatives.

- If this form is meant to retain any prior appointments, indicate that option and attach any necessary documents.

- Finally, after reviewing all entries for accuracy, save the document. You can then download, print, or share the completed form as needed.

Complete your documents online today to ensure you are properly represented in your tax matters.

The easiest and quickest way to resolve issues is to call the phone number printed on the notice or the Division of Taxation's Customer Service Center at 609-292-6400.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.