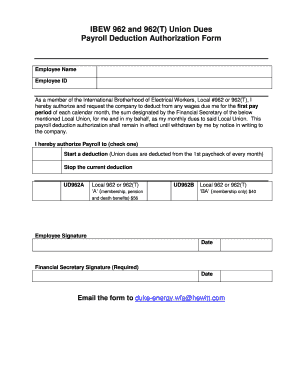

Get Ibew 962 And 962(t) Union Dues Payroll Deduction Authorization Form 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IBEW 962 And 962(T) Union Dues Payroll Deduction Authorization Form online

Filling out the IBEW 962 And 962(T) Union Dues Payroll Deduction Authorization Form is a straightforward process. This guide will provide you with clear instructions to complete the form effectively online, ensuring that your union dues are managed correctly.

Follow the steps to complete your payroll deduction authorization form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employee name in the designated field. This should include your first and last name as it appears on official documents.

- Input your employee ID in the appropriate section. This is usually your unique identifier provided by the company.

- Indicate your preference for payroll deduction by selecting either 'Start a deduction' or 'Stop the current deduction.' Check the appropriate box that corresponds to your choice.

- Choose the union type by selecting either Local 962 or 962(T) under the membership options. Make sure to indicate if you are opting for ‘A’ or ‘BA’ type funds.

- Sign the form in the Employee Signature section to authorize the deductions. Be sure to date your signature.

- Obtain the required signature from the Financial Secretary. This section must also be signed and dated.

- After completing all fields and obtaining necessary signatures, save your changes to the document, then download or print the completed form.

- Finally, email the completed form to the provided email address: duke-energy.wfa@hewitt.com.

Complete your IBEW 962 And 962(T) Union Dues Payroll Deduction Authorization Form online today!

With employee consent, employers can take some deductions from their paychecks. An employee must opt in if they want to take part in certain benefits. Employers must make mandatory deductions, such as federal, state, and local taxes, but employees have the option to opt in or out of voluntary deductions. What are payroll deductions | QuickBooks intuit.com https://quickbooks.intuit.com › payroll › deductions intuit.com https://quickbooks.intuit.com › payroll › deductions

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.