Loading

Get Statement Of Credit Denial Fillable 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Statement Of Credit Denial Fillable 2011 Form online

Filling out the Statement Of Credit Denial Fillable 2011 Form can be straightforward with the right guidance. This comprehensive guide offers clear instructions for each section of the form to support you in completing it effectively online.

Follow the steps to successfully fill out the Statement Of Credit Denial Fillable 2011 Form online.

- Press the ‘Get Form’ button to retrieve the Statement Of Credit Denial Fillable 2011 Form and open it in your preferred online editor.

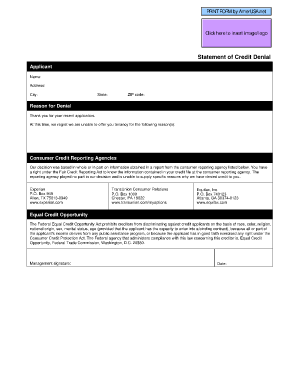

- In the 'Applicant' section, provide your name, address, city, state, and ZIP code. Ensure all information is accurate and complete to avoid any processing issues.

- Next, move to the 'Reason for Denial' section. Review the given statement thanking you for your recent application. This section is primarily informational and does not require any input from you.

- Locate the 'Consumer Credit Reporting Agencies' section. Here, no action is needed from you. This section explains your rights under the Fair Credit Reporting Act and includes the details of the credit reporting agencies that were consulted.

- Examine the 'Equal Credit Opportunity' section. This section provides information regarding the Federal Equal Credit Opportunity Act. Understanding these rights is important. No input is required here.

- Finally, sign and date the form in the space provided for the management signature and date. Make sure to complete this step as it acknowledges your awareness of the content and decisions.

- Once all information is entered and verified for accuracy, you can choose to save changes, download, print, or share the completed form as needed.

Begin completing your documents online today for a more efficient process.

A mortgage denial letter is a disclosure that the federal government requires lenders to send to a borrower who is unable to meet the financing criteria for a home loan request.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.